Post Covid-19 - Manufacturing

Greeting – Hello !! We are very glad to speak with you. We will make every effort to provide you with the best possible support. We sincerely ask for your kind advice and cooperation. Thank you.

The Japanese stock market continues to hit record highs, but could it be the crisis of COVID-19, which once shook the global economy, already become something of an “out of sight, out of mind” situation? The outbreak of COVID-19 began in 2019, from Wuhan, China. Next year - 2020, the World Health Organization (WHO) declared a pandemic, and manufacturing industry in the world faced unprecedented turmoil.

Now, let us look back at footprint of manufacturing industry for Japan over the past five years, with "Facts & Figures". Through this analysis, let's try to explore the insights for the future of Procurement and Supply Chains. Please stay tuned !

■Overview

2020: Supply Chain Collapse: The Day Everything Stopped

The COVID-19 pandemic pushed Supply Chain into collapse rapidly. Due to repeated breaks in communication with suppliers of parts and materials, the situation quickly became a "black box". A production management executive described: "We were completely in the dark, and the situation turned into a "black box". It was incredibly hard to create a recovery plan without the necessary data."

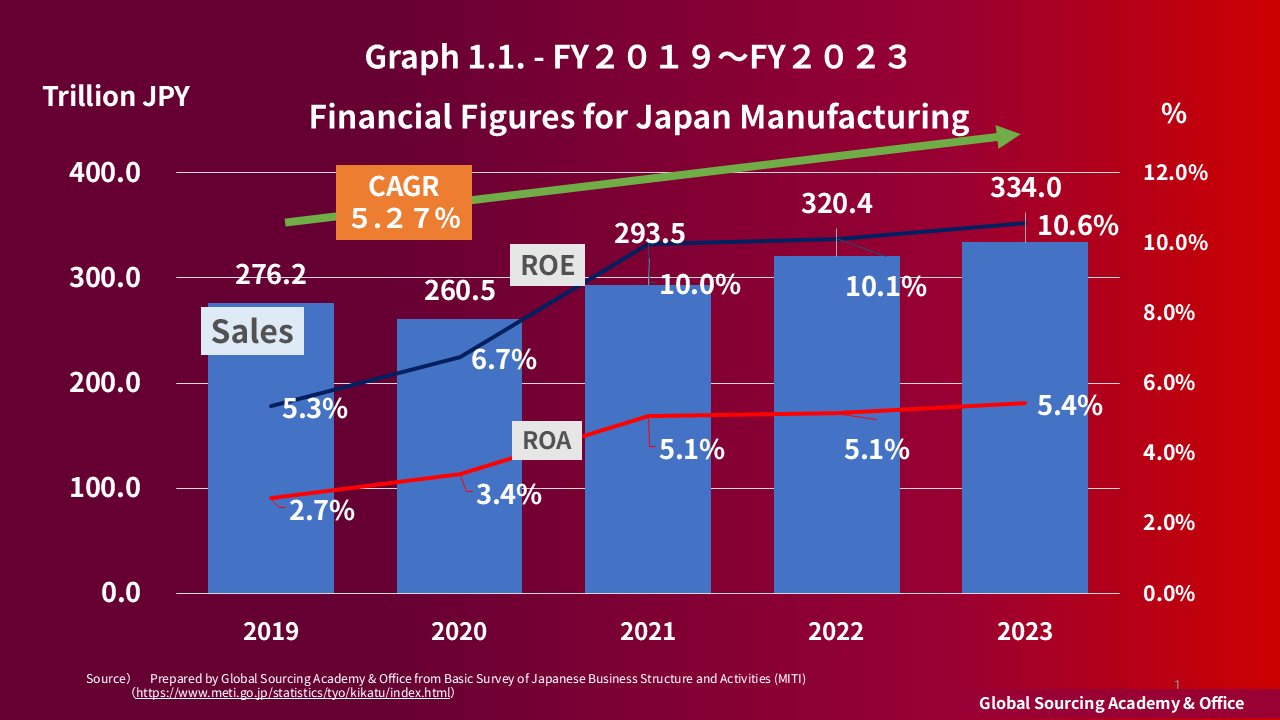

Consequently, the Sales Revenue of Manufacturing Industry in Japan dropped by 5.6% (Reference: Graph 1.1). That highlighted the risks of excessive dependence on specific regions. From that point, the strategy called “China +1 - China Plus One - ” strategy - which had been fading away in recent years - came back under the spotlight again.

Raw Material

- Crude Oil consumption stagnated due to COVID

- Drop down to 40USD/bl

Production

- Man-power shortage due to Lockdown

- Production Stop or Reduction.

Logistic

- Cargo ship, Container - Shortage

- Air cargo capacity shortage

Market

- Significant impact on chips

Just-in-Time Inventories、China+1

■ The COVID-19 pandemic, which restricted global sight in 2020, strongly reinforced the importance of "risk management,". But hope we remember, during the Great East Japan Earthquake, "BCP (Business Continuity Plan)" issues were raised up, then 2021, COVID-19 pandemic added "Visibility of Supply Chain" as if questioning - what we have learned from the past.

2021 Supply Chain Chaos Continues: Sales at the Mercy of Parts

The spread of the COVID-19 pandemic led us to consecutive lockdowns in major production regions - ASEAN, Mexico, and Europe, on top of China. This severely impacted Supply Chain across a wide range of industries, including automobiles, home appliances, motors, gaming consoles, and even semiconductors.

Adding to this disruption, a record-breaking cold wave struck Texas, USA. This caused large-scale power outages blackout and it forced world-class semiconductors' plants to halt operations. Production lines at plastic resin manufacturers in the region also stopped, it further made supply-constraints worse.

In this environment, where the ability to secure materials and components decides company's sales revenue, Suppliers (Sellers) frequently issued notice of "Force Majeure" and released successive announcements by their web sites about "Delays of Delivery". It was to avoid liability for non-performance.

Raw Material

- Crude Oil Price went up to around 70USD/bl

Production

- Production Stop or Decrease, Plant Shut-Down continues (automotive, motor, game console, others)

Logistic

- Grounding of Megaship in Suez Canal (Shifting Europe/Japan Sea Routes to the Cape of Good Hope)

Market

- Ongoing Chip Shortage and U.S.-China Trade Conflict (e.g., stricter sanctions against Huawei)

Multi-Sourcing

Contract (Force Majeure)

■ Procurement continuously received information from multiple sources. Timely internal communication and management decision-making were crucial for successful execution. In this context, in 2021, the linkage between timely information sharing and decision-making in Procurement and Corporate Management was widely recognized as one of the Key Success Factors (KSFs).

2022 Supply Limits, Cost Surges: Next, Profit Pressure comes

COVID-19 pandemic gradually started to ease. However, this sense of relief was short-lived, as the next challenge - Price Up - directly impacted "corporate profits". Shipping Cost, Crude Oil peaked in 2022. Crude Oil prices had been, in reality, steadily rising since 2020 (Graph 1.3 – Trends in Crude Oil Import Prices). Since the impact flows through the Supply Chain with a certain period of lead-time. All have been inflated from late 2021, and became visible on 2022.

The cost impacts on raw material came up in the second half of 2021, and for impacts on assembling manufacturing, became visible in 2022.

Note: in the same year, the world's largest foundry company, Taiwan's TSMC, began construction of a new plant in Kumamoto, Japan, raising expectations for an expansion of domestic semiconductor production capacity.

Raw Material

- Crude Oil hit Peak- 100USD/bl

Production

- "Zero Covid-19" by China, which caused plant operation Shut-Down as result.

Logistic

- Continued Cargo ship, Container - Shortage

Market

- Easing trend overall、Worldwide Semiconductor Shortage became chronic.

Price Hike Country Risk Geopolitics and Logistic

■ In 2022, a major turning point occurred, marking a shift from supply chain issues to rising prices. Many manufacturers likely faced the challenge of balancing "the redesign of sustainable Supply Chain" with "effective cost management", which may present a paradox.

2023 The Pandemic's Sunset: Dawning of a New Era of Risk

"In May 2023, the World Health Organization announced the end of the COVID-19 "State of Emergency". The severe Supply Chain breaks that occurred in 2020–2021 began to come down. However, the after-effects of the pandemic emerged as "Inflation (=Price Surge)", and put pressure on "corporate profits".

"Geopolitical risks" also had an impact. The prolonged Russian invasion to Ukraine affected the supply of natural resources. Neon Gas for the semiconductor production, as an example, is being raised as potential "Chokepoint" in the future. From the perspective of Economic Security, "European Chips Act" in 2023 which followed the U.S. "Chips Act", reflect a marked intensification of efforts to protect own-country industries and profit."

"ESG issues" also became visible. Several major IT companies had announced initiatives to eliminate "Child Labor" from their Supply Chain, yet challenges remain. In cobalt mining sites in the Democratic Republic of the Congo, which supply materials for smartphones and electric vehicles, children are still forced to engage in dangerous work by hands. In 2023, these companies faced significant international criticism for this issue as a result. (It is not point of the column, but the fact that the young generation protesting against such enterprises will become the major consumers in the future. They are the ones who will make choices for consumption !)

Raw Material

- Crude Oil down to 80USD/bl approx.

Production

- Child Labor

- Plant Wastewater

Logistic

- EU Port Strike

- Ship Attack

Market

- US-China trade friction

- EU Battery Regulations

- EU CSRD (Corporate Sustainability Reporting Directive)

ESG Risk (Human Rights, Enviroments, others) Economic Security, Geopolitics

<---------------------------------- Sustainable, Resilience ------------------------------>

■ In 2023, Europe, as a global "Rule-Maker", implemented various laws, regulations, and directives related to the environment and sustainability. In addition to the lingering pandemic impact, the growing importance of economic security and geopolitical risks, and ESG initiatives becoming essential for enhancing corporate value. These complex factors interconnect procurement with management more closely than ever before.

■Facts & Figures

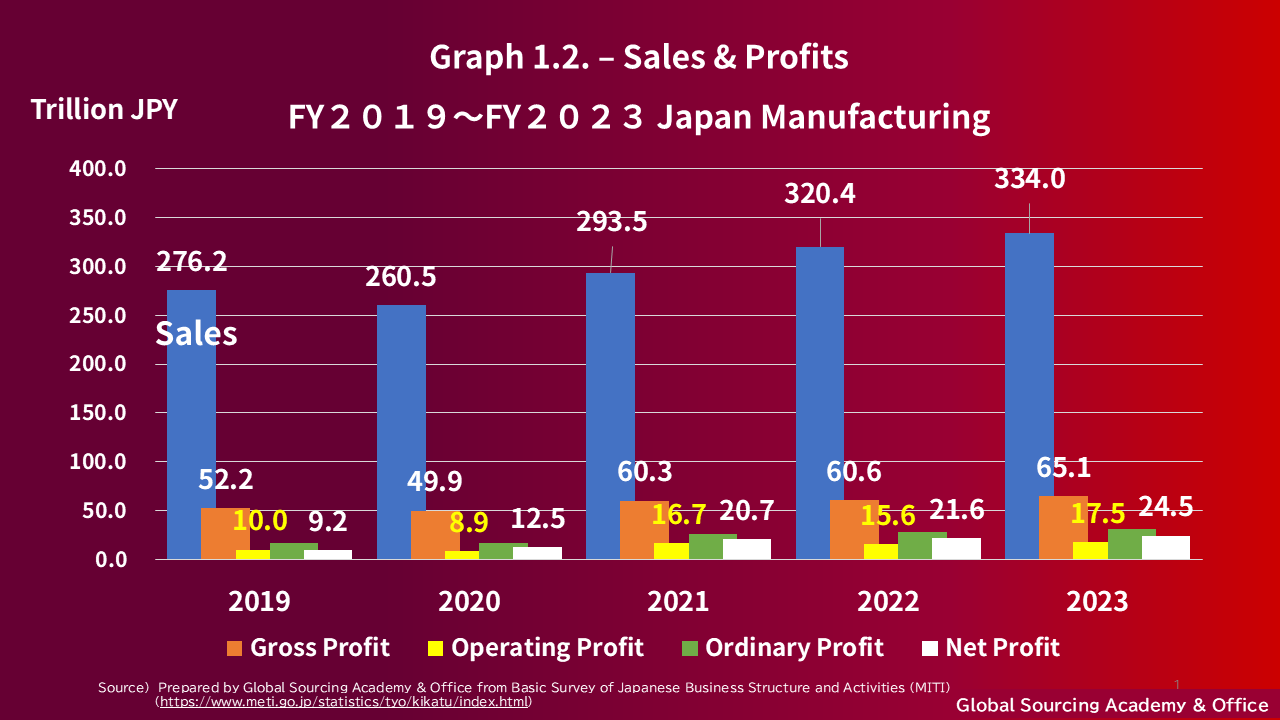

From 2019 to 2023, Japan's manufacturing showed clear signs of recovery. However, the Inflated prices that intensified in 2022, presented an unique financial paradox: a general increase in revenue was accompanied by a decline in operating profit but an increase in net profit for the period.

Graph 1.1. - 2019~2023

Financial Figures - Manufacturing in Japan

(Note: not include Overseas Business)

- 2019~2023:

- CAGR 5.27%

- 2020:

- Sales Rev by -5.6% Down

- 2023:

- ROE over 10%

Source: Prepared by Global Sourcing Academy & Office; refer to 2019 to 2023"Survey of Business Activities" (METI)

Graph 1.2. – 2019~2023

Financial Figures - Manufacturing in Japan

(Note: not include Overseas Business)

- 2022

- Operating Profit Ratio

-0.5% Down - Net Profit Ratio

-0.2% Down

- Operating Profit Ratio

Source: Prepared by Global Sourcing Academy & Office; refer to 2019 to 2023"Survey of Business Activities" (METI)

This counterintuitive result may suggest - while the surge in energy prices, global inflation, and ocean ship costs severely squeezed operating profits, with foreign exchange gains from the weaker yen, it provided a significant exchange rate gain as the total net profit for the term.

In essence, profitability from manufacturing struggle with Inflated Costs and Prices, yet were saved on the bottom line by favorable currency movements.

■Opinion

Procurement / Supply Chain: Point-of-View

Given that the year-over-year sales-to-profit margin did not show great improvement overall, and assuming that the procurement environment for materials and components remains largely "no change" from 2024 and after. This suggests that procurement may face greater expectations for cost reduction than ever before.

- The landscape surrounding procurement is shifting away from the "risks of the COVID-19 pandemic" to "a new set of emerging challenges".

- The future procurement agenda may call for balancing what may seem like conflicting priorities: "maximizing profits while minimizing risk".

- Today, companies, amid post-pandemic impacts such as inflation, economic security concerns, and ESG requirements, face strong pressure to stabilize their Supply Chain, manage Costs, and align with Business Strategies simultaneously.

- As a result, procurement will be required to demonstrate an even higher level of capability than it does today.

Before we make huge system solution, the simple 10 steps below is our office recommendation. Please try on the steps.

Quick Win

3 Key Points and 10 Checklist Items

- Risk Visibility Check

- Key Component by Country classification.

- Alternate Component Ratio

- Visibility Ratio on Your Tier 2 Suppliers

- Risk Minimization Check

- Financial Analysis on Critical Suppliers

- Contract Review (Force Majeure)

- Supplier Guidelines Review

- Supply Chain Crisis Hand Book

- Simplified Sourcing Judgement for Business Management

- Make Dual Source Strategies by Product Profitability, with R&D

- Cost Down Action Priority by Product / Business Profitability

- Procurement to participate in management meeting, do explanation "Supplier Map"

Rather than being too caught up in "buzzwords", why don't we take things Step-by-Step Approach, Let's start what we can do first. Let us suggest to try on three key points of "Quick Wins". We provide a variety of advice and support—please feel free to reach out to us."

To be continued.

Thank you.