Semiconductor Sourcing Strategy

■Where to buy

The essence of Sourcing

“Where should we buy from?”

This deceptively simple question is, without doubt, the very essence of sourcing. Yet the variables required to answer it have grown increasingly complex.

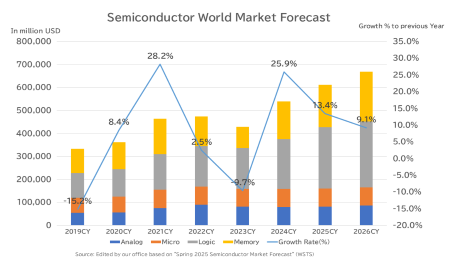

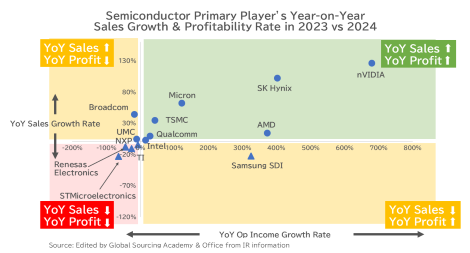

After a sharp decline in 2023, global semiconductor revenues showed a V-shaped recovery in 2024 (Image 1.3.). However, despite this overall rebound, some segments and markets are moving in very different directions (Image 1.4.)

Image 1.3. - World IC Market

Source: Edited by our office based on "Spring 2025 Semiconductor Market Forecast" (WSTS)

Image 1.4. - YoY Sales Growth & Profitability

Source: Edited by Global Sourcing Academy & Office from IR information

While the financial strength of semiconductor manufacturers is generally very robust, their business models are characterized by an extremely high ratio of fixed costs. This signifies that "fluctuations in sales directly impact profit." We strongly recommend reviewing financial statements and conducting a company-centric analysis, treating sourcing as a critical agenda item.

■Negotiation

The Logic of "Volume" and "Negotiation" When Dealing with Foreign Giants

Price negotiation is the climax of the sourcing process—it is the final stage of sourcing completion.

In today's semiconductor market, the majority of supply sources are dominated by major foreign companies based in the US, Europe, China, Taiwan, and South Korea. Whether the procurement route is through an agent or via direct manufacturer dealing, for Japanese companies to negotiate on equal terms with them, we must discard domestic business practices and understand the global "differences in rules."

However, semiconductors show the following differences compared to other parts and materials:

- Limited Number of Japanese Manufacturers

- Distributors are managed by the semiconductor manufacturers themselves.

- Semiconductors are a "The World of Numbers"

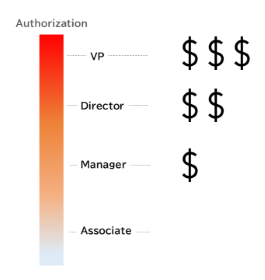

- In top-level negotiations, the authority to set prices typically resides at the VP level

- The majority of semiconductor suppliers are foreign companies, with most being major manufacturers based in Europe, the US, China, Taiwan, and South Korea. The actual party you negotiate with is either an agent (distributor) contracted by the semiconductor manufacturer or the manufacturer itself through direct negotiation.

- "Volume" is the Common Language

Semiconductors are truly a "Volume" game. Before even sitting down at the negotiation table, you must first re-examine the landscape within your own company.

The "ingenuity to create volume" is the key for successful negotiation. Such as Consolidating the Total Volume by breaking down departmental silos, Promoting Parts Commonality (Standardization), Increasing the Minimum Order Quantity (MOQ) for each part number becomes your first weapon in negotiations.

- A Negotiation Table Devoid of Implicit Deference

In negotiations with Japanese companies, we are often assisted by a sales representative's "internal coordination skills" (shanai chōsei-ryoku) and their "implicit deference" (sontaku).

However, this reliance on goodwill will not be effective in negotiations with foreign companies. Dialogue with them is not based on sentiment or emotion; it is a battle fought with logic and the strategic playing of "negotiation cards."

What we must recognize above all is the clear structure of decision-making authority within these global companies. The range of prices or discounts that can be offered is strictly controlled by position.

Therefore, when discussions stall at the operational level, escalating the conversation to a higher-ranking decision maker is not an act of pressure—it is a legitimate and necessary pathway for securing a strategic price.

Direct negotiations with manufacturers are indeed tough and demanding. Yet the reward of competitive pricing that lies beyond this challenge is a prize of unparalleled value in any sourcing strategy.

■Opinion

Procurement / Supply Chain: Point-of-View

Currently, Procurement DX (Digital Transformation) has entered the implementation phase, and many companies are seeing improvements in operational efficiency. However, a sober assessment reveals that much of this progress remains confined to the "Transactional" (routine operations) domain, such as processing purchase orders and managing delivery times. The realm of "Sourcing" (Strategic Procurement), which directly influences corporate competitiveness, remains a largely untouched challenge.

Among all categories, semiconductor sourcing is an extremely high-difficulty area. The complex interplay of global policies, administrative regulations in various countries, and an intricate industry structure means that semiconductor procurement is no longer merely the "purchasing" of a single material, but an advanced strategic issue that integrates Management, Technology, and Geopolitics.

It is difficult to respond to these changes using only internal resources. Therefore, establishing a procurement system known as a "Center of Excellence (CoE)"—which involves not only internal departmental collaboration but also external experts who are deeply familiar with the market—is highly suitable. Arming the organization with knowledge by incorporating external expertise will become the mainstream approach to future semiconductor sourcing.

We provide a variety of advice and support—please feel free to reach out to us."

To be continued.

Thank you