Post Covid-19 - Iron and Steel Industry

From 2019 to 2023, the global chemical industry faced a difficult environment on both the demand and supply sides. The steel industry, which has recently garnered renewed global attention, was no exception.

On the demand side, the lingering effects of the COVID-19 pandemic were particularly pronounced. In 2020, production declines in the automotive and construction industries sharply reduced steel demand. On the cost side, mirroring the surge in crude oil and naphtha prices, the prices of key raw materials for steelmaking — notably iron ore and coking coal — skyrocketed from 2021 onward. Rising energy costs further compounded the pressure, creating a severe squeeze on corporate profitability.

The result was an industry navigating a volatile period, where recovering demand and escalating costs coexisted, challenging even the most resilient steel producers.

■Players

Global Steel Geopolitics in Focus: China’s Dominance and Western Safeguards

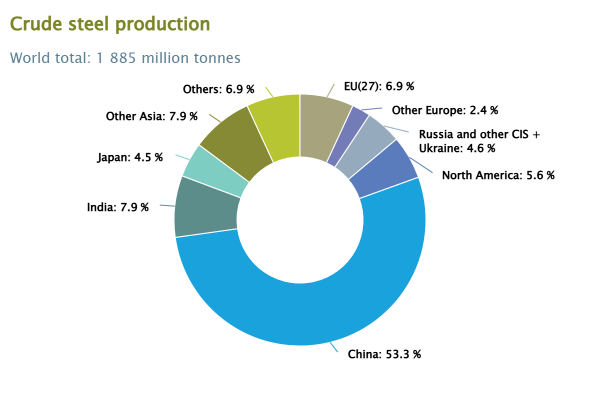

Looking at the major players in steel production, the global landscape is strikingly clear. As illustrated in Graph 1.a, China dominates the world’s crude steel production in 2024, accounting for more than 50% of the global total. India and Japan follow as the next largest producers.

Graph 1.a. - Crude steel Production (2024)

出典:Source: World Steel Association

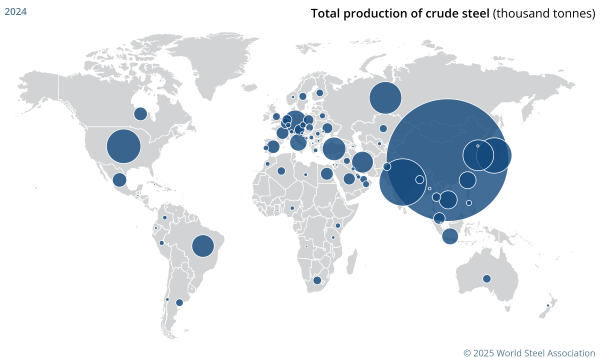

Graph 1.b. - Crude steel production

出典:Source: World Steel Association

China is not only the world’s largest steel producer but also its largest exporter, a position that has introduced significant tension into international trade balances. In response, the European Commission has reportedly strengthened its “steel safeguard measures” to protect domestic industries, applying tariffs of up to 50%, mirroring similar measures in the United States.

These actions are driven by concerns over China’s excessive production capacity and the persistent flow of low-cost imported steel into both the EU and the U.S. Western countries have long monitored steel import trends, maintaining oversight and investigations on targeted products. A notable example is the United States’ Section 232 in 2018, which imposed a 25% tariff on steel. Such measures have become emblematic of the geopolitical tensions surrounding global steel markets.

■Facts & Figures

V-Shaped Recovery Amid the Pandemic: Balancing Growth and Disruption

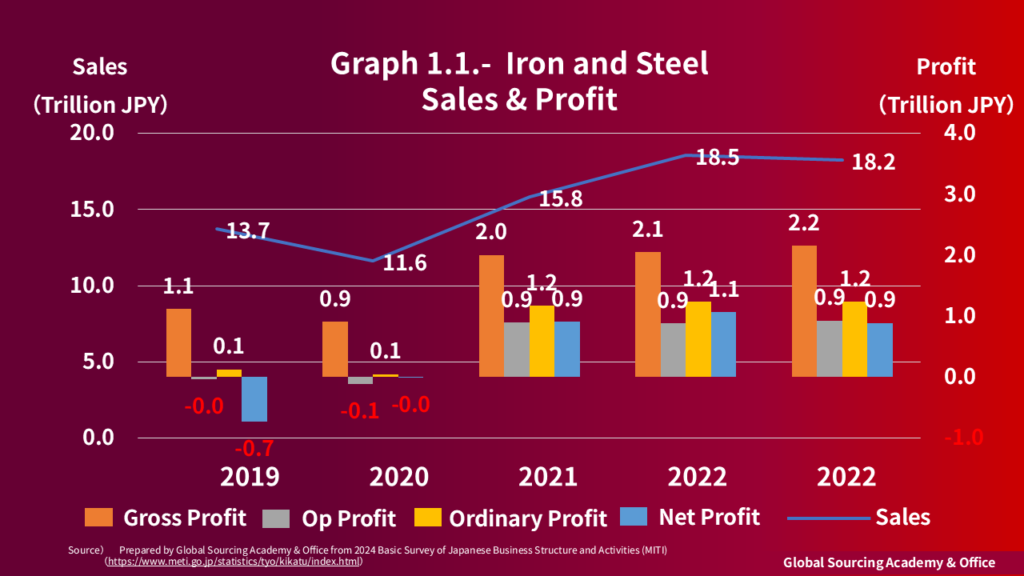

In 2020, the world faced the unprecedented shock of the COVID-19 pandemic. The steel industry was no exception, taking a severe hit that shook the very foundations of demand. In particular, sharp production cuts in the construction and automotive sectors caused steel demand to evaporate almost overnight. The impact rippled across the entire industry, leaving domestic steel producers in an exceptionally challenging situation (see Graph 1.1).

Graph 1.1. - Iron and Steel (Japan)_Sales & Profit

- 2019 / 2020 in the red figure

- 2021 Operating Profit to Sales 5.6%

- 2022 Operating Profit to Sales 4.8%

- 2023 Operating Profit to Sales 4.9%

Source: Prepared by Global Sourcing Academy & Office: refer to "Basic Survey of Japanese Business Structure and Activities" (METI)

However, the situation changed dramatically in 2021 as the global economy began to reopen. Stagnant automotive demand rebounded, and steel consumption quickly regained momentum. The industry experienced what could be described as a “V-shaped recovery,” temporarily regaining vitality.

Yet, much like the chemical sector, the surge in prices for key raw materials — notably iron ore and coking coal — hit profitability hard. The steel industry suddenly found itself navigating a volatile environment, where prosperity and disruption coexisted. Having seemingly overcome the pandemic’s impact, the sector now faced a new challenge: the pressure of rising input costs.

■Cost Driver

A Lifeline: Reliance on Imported Raw Materials

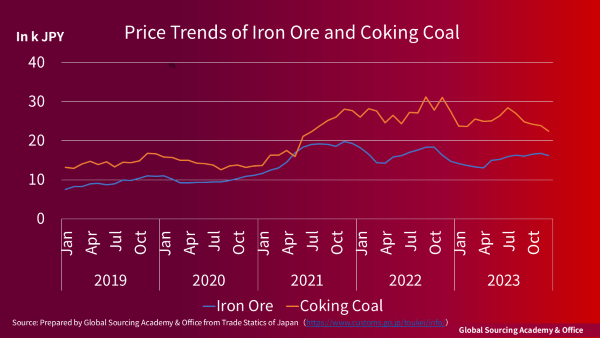

Just as the cost of plastics is driven by crude oil, naphtha, and energy, the cost of steel is largely determined by iron ore, coking coal, and energy expenses. In electric arc furnaces, scrap steel also serves as a major raw material.

Graph 1.2. - Iron Ore / Coking Coal Import Price (*1)

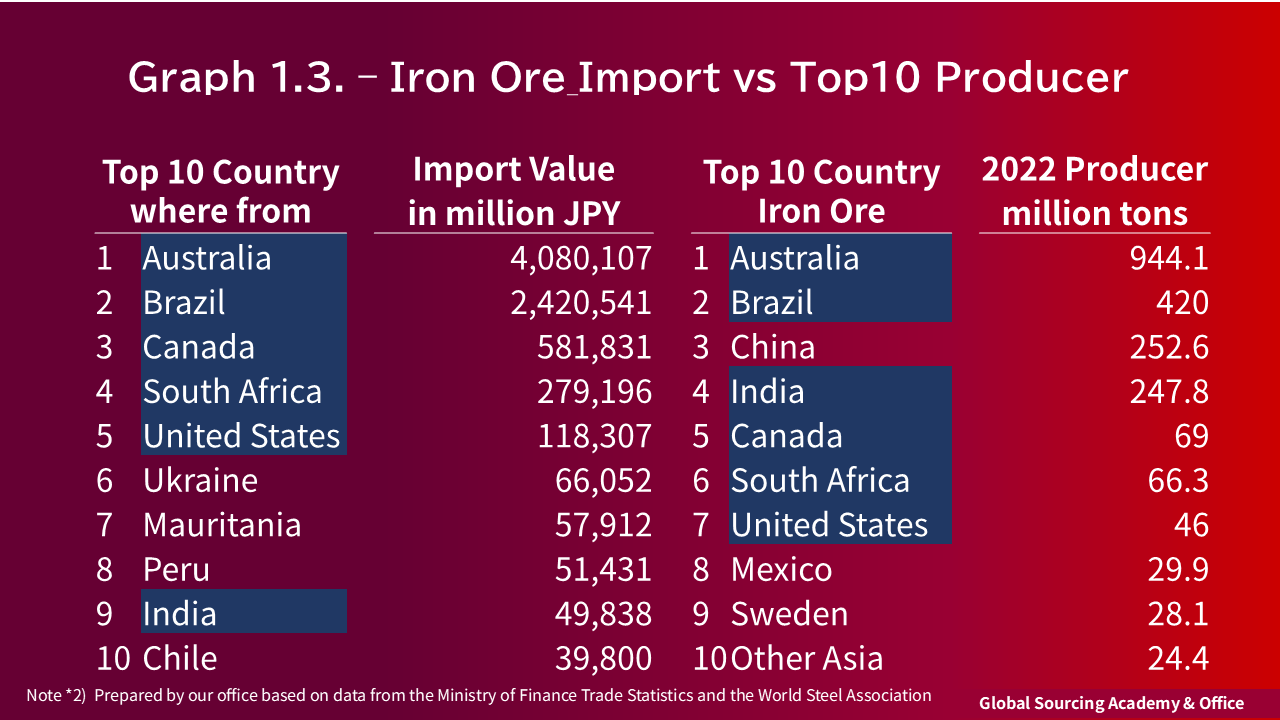

Graph 1.3. - Import Iron Ore vs. Top 10 (*2)

Source (*1): Prepared by Global Sourcing Academy & Office from Trade Statics of Japan

Source (*2): Prepared by our office based on Ministry of Finance trade statistics and the World Steel Association

Japan relies heavily on imports for much of its mineral resources, including iron ore and coking coal. For this reason, continuously monitoring key suppliers and price trends is of critical importance. Graph 1.3 compares Japan’s main import sources of iron ore with the world’s major producing countries. Japan has actively invested in top-producing nations such as Australia and Brazil to ensure stable resource procurement. Certain supplies from countries like Ukraine are also maintained.

China presents a unique case. While it is a major iron ore producer, it is simultaneously the world’s largest consumer and importer of the material. In other words, China imports more than it produces to meet its domestic demand, occupying a distinctive position as a “resource powerhouse that is not a major exporter.”

■Opinion

Procurement / Supply Chain: Point-of-View

In 2024, global steel demand shows signs of slowing, with major German steel producers announcing large-scale workforce reductions. Much like the chemical sector, the steel industry faces an air of uncertainty about its near-term prospects.

Looking ahead, China remains a key factor. With over 50% of the world’s crude steel production, its surplus capacity has historically shaped both supply-demand balances and pricing. Western protectionist policies are, in part, a response to curbing China’s dominance. Yet, as global competition intensifies, consolidation and restructuring across the industry are likely to accelerate further. Domestic demand trends, particularly in emerging economies, will also be critical indicators to watch.

Yet, pricing is not determined by supply and demand alone. The sourcing of raw materials, particularly iron ore and coking coal, along with energy costs, continues to exert a significant influence on corporate performance. While current conditions remain turbulent, Japan’s steel industry shines in the emerging “green steel” sector, leveraging its advanced technological capabilities in line with global decarbonization trends.

In these uncertain times, those engaged in procurement would do well to maintain a macro-level perspective, gaining a comprehensive understanding of market forces as the first strategic step forward.

- Demand vs. Supply (move of China)

- Financial Performance of Major Players

- Way of Ensuring the Supply of Key Resources by Major players

- New Regulations and Directives under Economic Security Measures

We provide a variety of advice and support—please feel free to reach out to us."

To be continued.

Thank you