Post Covid-19 - Chemical Industry

The five years from 2019 to 2023 were a time of period which Japan’s chemical industry was repeatedly confronted with drastic changes in the external environment as well. Through the background of the global trend toward environmental issues, the industry embarked on the path to carbon neutrality.

Efforts such as the development of plant-based biochemicals and the acceleration of plastic recycling by users became more active. It could be said the chemical industry one of the representative industry that proactively advanced initiatives for future sustainability. Now how you will see their future ?

■Facts & Figures

Stagnant Demand, Squeezed Profitability

In 2020, the sudden imbalance of "Demand vs Supply" was caused by the COVID-19 pandemic and became a major challenge for plastic resin manufacturers. The sharp downturn in the automotive market was so painful to our industry. At the same time, however, “stay-at-home demand” helped offset part of the decline. With the expansion of telework and online learning, demand increased specially for ABS resin and polycarbonate used in personal computer and printer housings, also for polypropylene that's used for mask (nonwoven fabrics). On the other hand, low-cost Chinese resins gained a stronger presence for normal grade application, yet the ongoing weakening of the yen ultimately made further imports more challenging.

In February 2021, a severe cold wave in Texas forced chemical plants to halt operations, causing a serious disruption in the supply of ethylene and propylene-based resins, especially. The following year, the Russia–Ukraine conflict drove Crude Oil, Natural Gas, and Naphtha Prices sharply higher, adding pressure as global supply-demand imbalances "squeezed profitability". By 2023, Naphtha prices had begun to decline, yet the simultaneous depreciation of the yen kept costs elevated, leaving companies still struggling under sustained pressure on their margins.

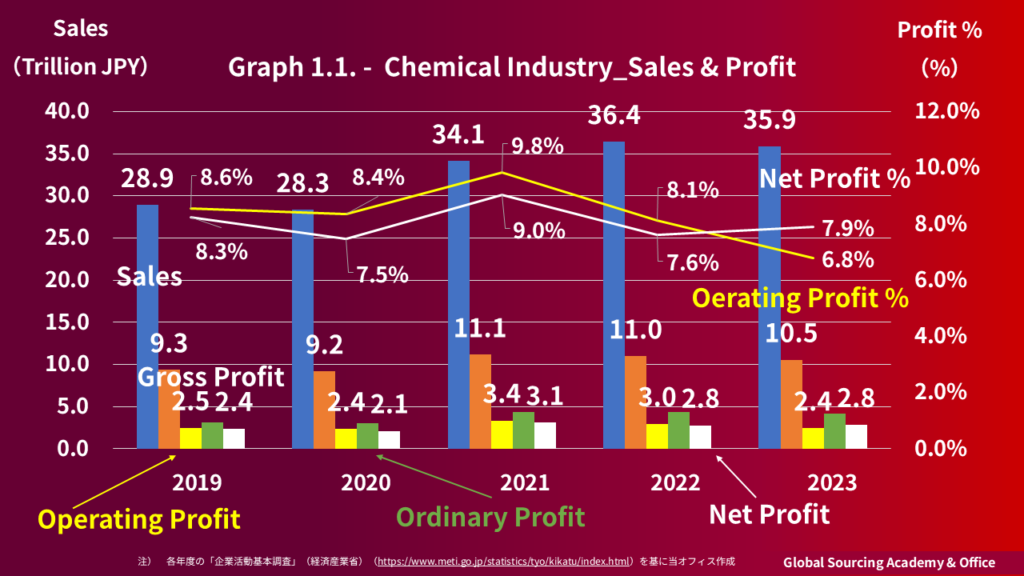

Graph 1.1. - Chemical Industry_Sales & Profit

- FY2022

- Operating Profit %

-1.7% Down vs. FY2021 - Net Profit %

-1.4% Down vs. FY2021

- Operating Profit %

- FY2023

- Operating Profit %

-1.3% Down vs. FY2022 - Net Profit %

+0.3% Up vs. FY2022

- Operating Profit %

Source: Prepared by Global Sourcing Academy & Office: refer to "Basic Survey of Japanese Business Structure and Activities" (METI)

■Cost Driver

The Never-Ending Cost Crisis

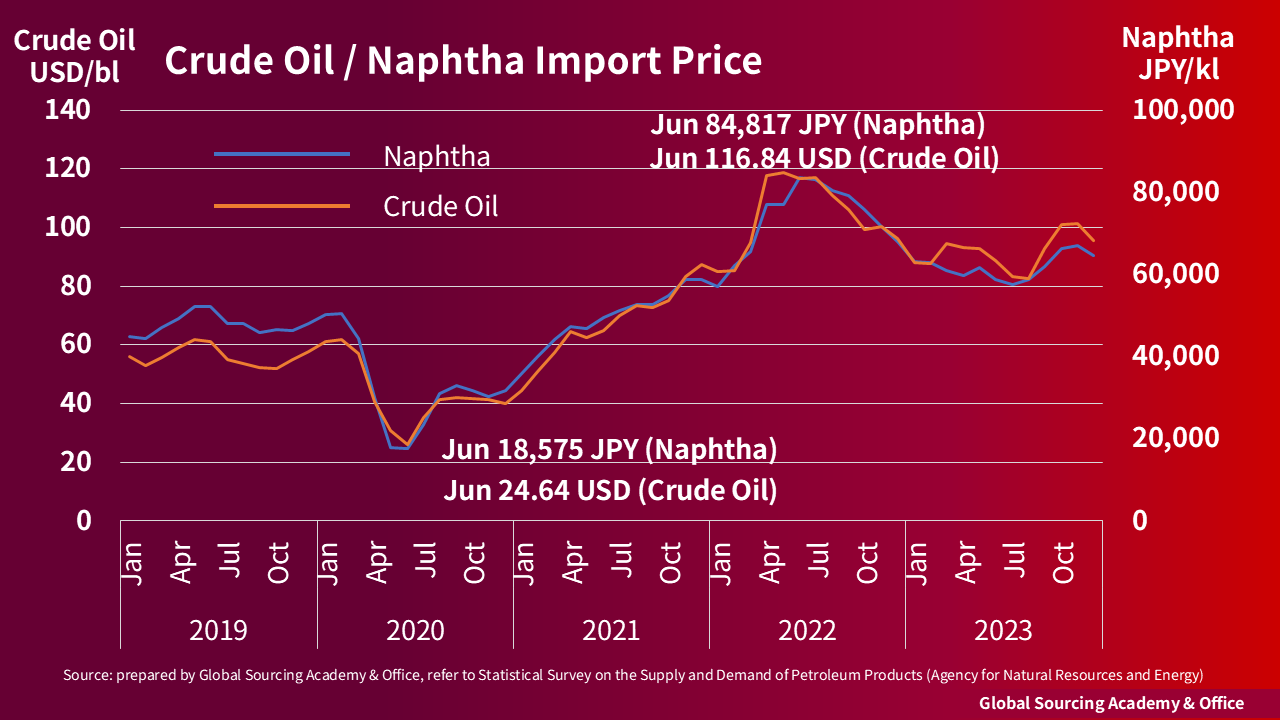

In 2023, although naphtha prices began to decline, the depreciation of the yen continued. The price of imported naphtha fluctuated from a peak of approximately 85,000 yen/kl to around 60,000 yen/kl (See. Graph 1.3., 1.4.) however, this merely returned it to 2021 levels,

Graph 1.3. - Crude Oil / Naphtha Import Price

- FY2022

- Due to Covid-19, Consumption Down outstandingly

- Crude Oil Price went down drastically

- FY2022

- COVID-19 pandemic gradually started to ease

- Crude Oil went up siginificantly

Source: Prepared by Global Sourcing Academy & Office; refer to Yearbook of Petroleum Statistics」(Agency for Natural Resources and Energy)

■Market

Something Feels Off… What’s Behind It?

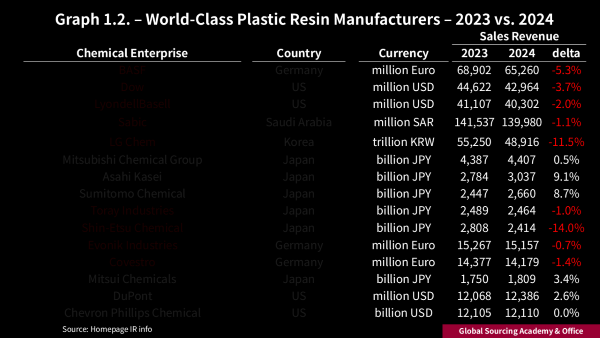

Given the decline on Operating Profit, it will be good to know the financial performance for FY2024. As an alternative, an analysis was conducted by comparing the net sales (or revenue) of 15 world-class plastic resin manufacturers (excluding China) for 2023 vs. 2024 (Graph 1.2.). The data suggests that declined performance on 9 out of 15 manufacturers from 2023 to 2024, a trend especially noticeable among companies in Europe and the US.

Graph 1.2. - Primary Plastic Resin Manufacturers' Sales

Source: IR Information of Homepage

- Graph 1.2. - 15 world class plastic resin manufacturers Sales (except. China) in 2023 vs 2024.

- Continued declined trend toward 2024

- Outstanding declined trend on Europe and US manufacturers

■Opinion

Procurement / Supply Chain: Point-of-View

Is something shifting ? Considering the deterioration in profitability seen in FY2022 and FY2023, coupled with the FY2024 sales trend (year-on-year) and the uncertain economic outlook, regular analysis of demand and supply capacity (production capability) is now even more crucial for procurement strategy. In fact, several major plastic resin manufacturers in Europe and the U.S. have announced actions such as workforce reductions. Chemical companies generally have a strong financial foundation; however, continuation of unprofitable businesses may be a potential question. Therefore, a reassessment of their business portfolio is likely essential.

Plus, we may need pay attention how China moves as they are big manufactures on nomal grade polypropylene, polyethylene. Excessive capacity by China's move, it will generate different pictures in buyer's market vs seller's market. “The relationship between the buyer’s market vs. the seller’s market is much like the silicon cycle in the semiconductor industry. We should keep in mind that after a buyer’s market, the seller’s market will inevitably return with price increase demands. ”Building strong partnerships with suppliers is vital. We may need balance both immediate supply-demand challenges and our long-term strategies.

Additionally, there is a potential concern that investment in areas which is nothing has to do directly with manufacturing itself may be restrained, suggesting that a review of the allocation of management resources may be necessary. Considering Japan’s position as the world’s second-largest producer of plastic waste and its response to the European Green Deal policy, there are concerns that plastic recycling efforts may stagnate.

- Review of the financial statement and business portfolio of manufacturers in Chemical industry.

- Analysis of Supply vs. Demand Balance (Seller’s Market vs. Buyer’s Market)

- Continuous monitoring of Crude Oil and Naphtha trends, which are key cost drivers

- Possible delays on investment for Environmental initiatives due to financial resource priority

We provide a variety of advice and support—please feel free to reach out to us."

To be continued.

Thank you